Regulated & Deregulated Energy Markets

If your company operates in more than one state, or electricity grid, you might also be operating in both regulated and deregulated energy markets. When you are making decisions about purchasing energy, it is important to know the difference between these markets and develop a plan that will make sure your company gets the right renewable energy solution.

Electricity markets are highly diverse.

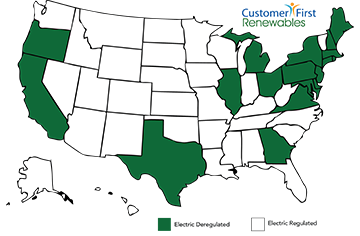

In a regulated electricity market, vertically integrated monopoly utilities cover the entire value chain with oversight from a public regulator. The utility makes sure that power is generated, sent to the grid, and reaches customers. Customers in regulated markets cannot choose who generates their power and are bound to the utility in that area. Regulated markets dominate most of the Southeast, Northwest and much of the West (excluding California).

In a deregulated electricity market, market participants other than utility companies own power plants and transmission lines. In such instances, generators (companies that generate electricity) sell electricity into a wholesale market, and retail energy suppliers purchase this electricity to sell it to customers. Transmission companies or utilities own and operate the transmission grid. This market universe is managed by an independent system operator (ISO) or regional transmission organization RTO. Your utility company is still around – It makes sure the power is distributed and everything is working correctly to keep your lights on.

Deregulated markets have opened up generation for competition from independent power producers in 24 states, such as California, Texas and most states in the Northeast. 18 of these states and Washington D.C. have also introduced retail choice, which allows residential and/or industrial consumers to choose their own electricity provider. Customers benefit from more competitive rates and generation options, including renewable energy.

It is important to note that the market is not split clearly between regulated and deregulated states. Some states, like California, are partially regulated markets. This is due to the nature of the grid, historic reasons and the geographic boundaries of utility territories in neighboring states.

So your company wants to get renewable energy. What does this mean?

As part of the Renewable Energy Buyers Alliance (REBA), World Resources Institute recently launched a Corporate Strategy Map to help corporations identify some renewable energy solutions (mainly retail choice options and utility green tariffs) in different states.

Still, if your company is located in a regulated state, developing a large-scale renewable project inside your state and claiming renewable energy use is challenging, and may not be possible at all. In regulated states most renewable energy projects are utility-owned. Furthermore, few utilities offer green pricing programs that fully meet the Corporate Buyers Renewable Energy Principles of cost-effective and impactful renewable power.

The good news is that even if you are located in a regulated state you can still engage in renewable energy, either on your own or aggregated with other organizations. Your company can use “indirect” physical or financial contract structures by entering into a Power Purchase Agreement (PPA) with an offsite project located outside your state. Your company can then claim the benefits of this renewable energy by retaining ownership of project-specific renewable energy certificates (RECs). Your existing grid power supply arrangement will stay in place, while your company is helping green the grid in the U.S. and receiving environmental and economic benefits from a renewable energy project.

If you are located in a deregulated state, there are more options, some of which include incorporating renewables directly into your retail supply contract. Your organization can also aggregate demand with others to create a larger impact project than you would have accomplished alone. Furthermore, in a deregulated state, there is increased flexibility around the structure of the contract, the location of the project, and the scale of selected renewable source.

Bottom line: The value proposition associated with large-scale renewable energy projects – lower costs, reduced future price risk, lower GHG and other strategic benefits – is available, no matter the regulatory regime for your organization’s U.S. footprint.

| State | Electric Market |

| Alabama | Regulated |

| Alaska | Regulated |

| Arizona | Regulated |

| Arkansas | Regulated |

| California | Deregulated for some commercial & industrial consumers* |

| Colorado | Regulated |

| Connecticut | Deregulated* |

| Delaware | Deregulated* |

| District of Columbia | Deregulated |

| Florida | Regulated |

| Georgia | Deregulated for some commercial & industrial consumers* |

| Hawaii | Regulated |

| Idaho | Regulated |

| Illinois | Deregulated* |

| Indiana | Regulated |

| Iowa | Regulated |

| Kansas | Regulated |

| Kentucky | Regulated |

| Louisiana | Regulated |

| Maine | Deregulated* |

| Maryland | Deregulated* |

| Massachusetts | Deregulated* |

| Michigan | Deregulated for some commercial & industrial consumers* |

| Minnesota | Regulated |

| Mississippi | Regulated |

| Missouri | Regulated |

| Montana | Regulated |

| Nebraska | Regulated |

| Nevada | Regulated* |

| New Hampshire | Deregulated* |

| New Jersey | Deregulated* |

| New Mexico | Regulated |

| New York | Deregulated* |

| North Carolina | Regulated |

| North Dakota | Regulated |

| Ohio | Deregulated* |

| Oklahoma | Regulated |

| Oregon | Deregulated for some commercial & industrial consumers* |

| Pennsylvania | Deregulated* |

| Rhode Island | Deregulated |

| South Carolina | Regulated |

| South Dakota | Regulated |

| Tennessee | Regulated |

| Texas | Deregulated* |

| Utah | Regulated |

| Vermont | Regulated |

| Virginia | Deregulated for some commercial & industrial consumers* |

| Washington | Regulated |

| West Virginia | Regulated |

| Wisconsin | Regulated |

| Wyoming | Regulated |

*States may be partially regulated/deregulated, regulated only in some utility markets, or deregulated for industrial consumers. Additional information available at the American Coalition of Competitive Energy Suppliers.