Tax Credits & Transferability 2024

September 25 - 26, 2024

C. Baldwin, Curio Collection by Hilton

Houston, TX

Get Up to Speed on Optimizing the Use of Incentives & Tax Credit Sales from the Most Consequential Clean Energy Finance Legislation in U.S. History!

Two years ago, the IRA created a revolutionary new regime to provide tax credits for an expanded range of clean energy investments, using tax credit sales to expand the pool of potential investors to include corporations that hitherto had little if any experience in the energy sector, but also introducing a series of adders that could substantially decrease capital costs. While this clearly represented, and represents, a golden opportunity to mobilize funding for a huge number of clean energy projects, it set market participants the task of discovering exactly how to structure financings that could monetize depreciation, capitalize on step-ups in FMV (fair market value), and protect participants when claiming new incentives—all necessary to utilize the full range of capital now available from both traditional tax equity and corporate tax credit buyers.

Today, however, the market is field-testing a series of structures and tools to optimize the financing of a wide variety of projects using the full range of tax credits. What lessons are being learned in newly closed T-flip and transfer deals? How are players dealing with the risks of claiming domestic content, prevailing wage and apprenticeship (PWA), and energy community incentives? If you want to take full advantage of the remarkable techniques now available to finance traditional solar and wind projects, as well as storage, CCS, RNG, manufacturing, hydrogen, and other new technology projects, you need to fully understand tax equity market conditions and the new structures coming to the fore.

Infocast, in organizing Tax Credits & Transferability 2024: Optimizing Post-IRA Opportunities, has brought together the markets’ leading practitioners, sponsors, and investors to get attendees 100% up to speed on today’s most important issues in this exceedingly dynamic space. You will get critical insights on the development of the transfer market, how to best meet and document compliance with new domestic content, PWA, and energy community requirements, and the ins and outs of tapping into funding through 45Q, 45V, 45X, and 45Z credits, and more.

No other event can provide you with the type of deep dive—guided by active market players—that you will find here into the following essential topics:

- Emerging Structures for Post-IRA Tax Equity and Transferability Transactions—Traditional, T-Flip, and Transfer Deals

- Building Tax Credit Transferability Deal Flow—Roles of Banks, Brokers, Platforms, and Other Players

- Negotiating Post-IRA Deals Incorporating Tax Equity—Strategies for New Risk Allocation and Assignment Concerns

- Methods of Incorporating Depreciation, Step-ups, and Other Financial Issues in T-Flip Structures

- Optimizing the Tax Benefits and the Capital Stack: What Are We Seeing in Hybrid/T-Flip and Transferability Transactions?

- Tax Credit Buyers’ Perspectives on Renewable Energy Tax Equity Deals

- Insurer Perspectives on Mitigating and Indemnifying Risks in Tax Credit Transfer Deals—Where Is the Market Headed?

- Developer and Project Sponsor Perspectives on Making Tax Equity and Transfer Deals

Review our carefully designed outline and remarkable faculty and reserve your place today.

55

Expert Speakers

Hear from top industry leaders

and market stakeholders

14

Content-Packed Sessions

Gain highly-relevant,

exclusive insights and updates

Premier Networking

Connect with key decision-makers

and get deals done

FEATURED SPEAKERS

Bryen Alperin

Partner & Managing Director

FOSS & COMPANY

Jack Cargas

Managing Director, Renewable Energy Finance

BANK OF AMERICA

Shirley Chin

Head of Tax

WTW

Anand Dandapani

Executive Director, Energy Investments

J.P. MORGAN

Ian Davis

Managing Partner

ONPEAK POWER, LLC

Bryan Didier

Partner and Managing Director, Renewable Energy

MONARCH PRIVATE CAPITAL

Merrill Fowlkes Hoopengardner

Vice President, Head of Renewable Tax Credit Syndication

SB ENERGY

Bailey Johnson

Executive Director, Renewable Energy & Environmental Finance

WELLS FARGO

Kevin Knight

Managing Director

GE ENERGY FINANCIAL SERVICES

Kami LaBerge

Senior Vice President, Tax Underwriter

EUCLID TRANSACTIONAL

Whitney LaNasa

Senior Managing Director

STONEHENGE CAPITAL

Christopher Maslanka

Director, Renewable Structured Finance

DERIVA ENERGY

Sunil Paul

Co-Founder and CEO

SPRING FREE EV, INC.

Jon Previtali

Senior Principal Engineer

VDE AMERICAS

Emily Rose

Associate Director, Head of Renewable Energy Investing

SCHNEIDER ELECTRIC

Edwin Stone

Executive Director, Project Finance

CIBC CAPITAL MARKETS

Reid Strand

Vice President of Finance

PEREGRINE ENERGY SOLUTIONS

Jordan Tamchin

Executive Vice President, Tax Insurance Practice Leader

CAC SPECIALTY

Hannah Tucker

Assistant Vice President

QBE

Patrick Worrall

Vice President

LEVELTEN ENERGY

HEAR FROM INDUSTRY LEADERS & EXPERTS

- A&O Shearman

- Acadia Infrastructure Capital

- Ares Management

- Ashtrom Renewable Energy

- Atheva

- Baker Botts

- Bank of America

- BDO

- Berkshire Hathaway Specialty Insurance

- Bildmore Clean Energy

- Birch

- Bracewell LLP

- CAC Specialty

- CapeZero

- CIBC Capital Markets

- Concentro

- Copia Power

- Crux

- Davis Polk

- Deriva Energy

- DLA Piper

- Earthrise Energy

- Empact Technologies

- Energy Re

- Euclid Transactional

- Foss & Company

- GE Energy Financial Services

- Greenberg Traurig

- J.P. Morgan

- LevelTen Energy

- Liberty GTS

- Lockton

- McDermott Will & Emery

- McGuireWoods

- Monarch Private Capital

- Morgan Stanley

- Nautilus Solar

- Norton Rose Fulbright LLP

- OnPeak Power, LLC

- Peregrine Energy Solutions

- QBE

- Reunion

- Santander

- SB Energy

- Schneider Electric

- Spring Free EV, Inc.

- Stonehenge Capital

- VDE Americas

- Weil, Gotshal & Manges

- Wells Fargo

- WTW

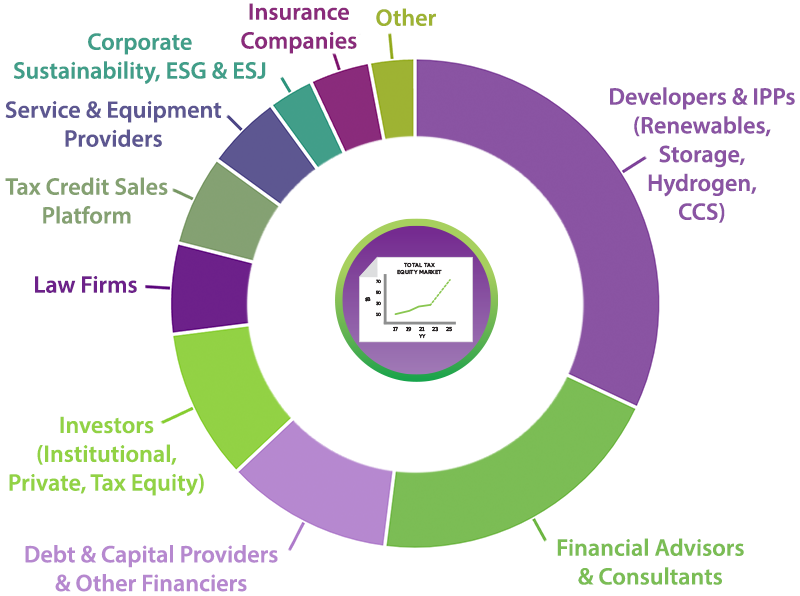

WHO SHOULD ATTEND?

- Solar, Wind and Storage Developers

- Hydrogen Developers

- Consulting and Analytics

- Equipment Manufacturing & Suppliers

- Insurance & Risk

- Investment Banks and Lenders

- Law Firms

- Tax Investment

- CCS Developers

- Asset Management

- Engineering, Procurement and Construction

- General Partners and Private Equity

- Investment Advisors

- IPPs

- Platforms

- Utilities

PAST PARTICIPATING ORGANIZATIONS

- 547 Energy

- AB Power Advisors

- Advanced Racking

- AdvantageCapital

- AES

- Affordable Community Energy Services Company

- AIP Management

- Akin Gump Strauss Hauer & Feld LLP

- Alchemy Renewable Energy

- Algonquin Power

- AlphaStruxure

- Alvarez & Marsal

- Amergy Solar

- Apex Clean Energy

- Ares Management

- Baker Tilly Capital LLC

- Ballard Power Systems

- Bank of America

- Barlo Ventures, LLC

- Barnes & Thornburg LLP

- Bechtel Enterprises

- Blue Sky Solar

- Bluestem Energy Solutions

- BlueWave Solar

- BNRG

- BOA

- Bostonia Partners LLC

- Bracewell LLP

- Broadwind Energy

- Buckeye Partners, LP

- CACIB

- Cadmus

- Calpine

- Capstone Infrastructure Corp

- Cardinal Investment Company

- CIBC

- City National Bank

- CleanCapital

- Cleantech Strategies

- Clearway Energy Group

- Cleco

- CoBank

- Cohen & Company

- Con Edison Clean Energy Businesses

- Connected Solar

- Constellation

- Convergent Energy + Power

- Cubico Sustainable Investments

- DBJ Americas Inc

- DNB Bank ASA

- Doral Renewables

- DTE Energy

- Duke Energy

- EDF Renewables

- Elemental Energy

- Enbridge

- Enel Green Power

- ENGIE North America

- Exus Management Partners

- Foley & Lardner LLP

- Forefront Power

- Foss and Company

- FTC Solar

- FTI Consulting

- Galehead Development

- Gallagher Evelius & Jones LLP

- Globus Thenken

- Haynes Boone

- Heelstone Renewable Energy

- Hitachi Zosen Inova

- Holland & Hart LLP

- ibV Energy Partners

- Ignis Energia

- Jones Walker LLP

- JX Nippon

- Kaiser Permanente

- Katten Muchin Rosenman LLP

- Kendall Sustainable Infrastructure

- Latham & Watkins LLP

- Lazard

- Leeward Renewable Energy, LLC

- Lendlease

- Leyline Renewable Capital

- Liberty Utilties

- Macquarie

- Marsh

- Marshall & Stevens

- MassAmerican Energy, LLC

- MegaJoule

- Meridian Investments

- Mitsubishi Heavy Industries America, Inc.

- Monarch Private Capital, LLC

- Moore & Van Allen

- Moss Adams LLP

- National Cooperative Bank

- National Foundation for Affordable Housing Solutions, Inc.

- National Grid Renewables

- National Renewable Energy Corporation

- Nationwide Insurance

- Nelson Energy LLC

- New Energy Solar

- NextEra

- Nexus PMG

- Nixon Peabody LLP

- Nobell Energy Solutions, LLC

- NRStor C&I LP

- Oriden

- Pacific Gas & Electric

- Partner Engineering and Science

- Phillips Lytle LLP

- Photosol US Renewable Energy

- Pine Gate Renewables

- PPL Corporation

- Puget Sound Energy

- PVHardware (PVH)

- Quantum Energy Partners

- Rabobank

- Radian Generation

- Rath, Young and Pignatelli PC

- Recurrent Energy

- Regions Bank

- Revity Energy LLC

- River Crest Power

- Rockwood Group

- Saturn Power Inc.

- Shell Energy North America

- Sive, Paget & Riesel, P.C.

- Skyline Renewables

- Solar Landscape

- Solariant Capital

- Solaris Global LLC

- Solas Energy Consulting

- Solect Energy

- Southern Power

- Spano Partners

- Spark Analytics

- Stinson LLP

- Stonehenge Capital Company, LLC

- SunPeak

- SWEB Development

- Swift Current Energy

- Telamon Enterprise Ventures

- Telios Corporation

- Tenaska

- Terra Energy

- The Wishcamper Companies

- Treehouse Investments, LLC

- Truist

- U.S. Department of Agriculture

- U.S. Energy Development Corporation

- UKA North America Group

- Urban Grid

- US Bank

- US Department of Energy

- Vineyard Wind LLC

- Vitol Inc.

- Wartsila

- Wells Fargo

- Williams Enterprises

- Wintec Energy

- Winthrop & Weinstine, P.A.

- Wilson, Sonsini, Goodrich & Rosati

- Yale School of Management

- Zorya Energy Advisors

2023 RECAP

190+

Event Participants

50

Expert Speakers

13

Content-Packed Sessions

VENUE

C. Baldwin, Curio Collection by Hilton

400 Dallas Street

Houston, TX 77002

Phone: (713) 759-0202

WARNING: Please do not book any guest rooms with third-party housing companies for this event. Infocast does not partner with outside housing companies, so we advise that you only book guest rooms directly through the venue using the details provided above.

Nearby Hotels

No special group rates available, based on current available rates.

Hyatt Regency

Houston Downtown

1200 Louisiana St, Houston, TX 77002

+1 (713) 654-1234

Courtyard Houston

Downtown/Convention Center

916 Dallas St, Houston, TX 77002

+1 (832) 366-1600

The Laura Hotel, Houston Downtown, Autograph Collection

1070 Dallas St, Houston, TX 77002

+1 (713) 242-8555

JW Marriott Houston Downtown

806 Main St, Houston, TX 77002

+1 (713) 237-1111

AC Hotel Houston Downtown

723 Main St, Houston, TX 77002

+1 (832) 516-6635

Club Quarters Hotel Downtown, Houston

720 Fannin St, Houston, TX 77002

+1 (713) 224-6400

Aloft Houston Downtown

820 Fannin St, Houston, TX 77002

+1 (713) 225-0200

Le Méridien Houston Downtown

1121 Walker St, Houston, TX 77002

+1 (713) 222-7777

Hyatt Place Houston / Downtown

1114 Texas Ave, Houston, TX 77002

+1 (832) 930-8500

The Whitehall

1700 Smith St, Houston, TX 77002

+1 (855) 318-8945

Magnolia Hotel Houston, a Tribute Portfolio Hotel

1100 Texas Ave, Houston, TX 77002

+1 (713) 221-0011

Sponsors

Summit Sponsor

Platinum Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Silver Sponsor

Silver Sponsor

Silver Sponsor

Silver Sponsor

Lanyard Sponsor

Reception Sponsor

Exhibitor

Exhibitor