January 12 - 14, 2026 | Hyatt Regency New Orleans | New Orleans, LA

January 12 - 14, 2026 | Hyatt Regency New Orleans | New Orleans, LA

Projects & Money is the essential kickoff to the project finance year—bringing together the country’s top developers, investors, and lenders to map the trends, tactics, and capital strategies that will define energy dealmaking in 2026 and beyond.

Returning to New Orleans January 12–14, this premier gathering is where senior leaders in project development and finance converge to explore the evolving landscape across clean energy, natural gas, thermal, and storage. You’ll hear directly from those shaping the market on how they’re navigating shifting tax policy, regulatory changes, and financial pressures stemming from the One Big Beautiful Bill Act and other major developments.

As the first major energy finance conference of the year, Projects & Money will provide:

High-powered networking is at the heart of Projects & Money — structured and spontaneous — designed to help you meet the key players who can help move your projects forward. You’ll walk away with fresh intelligence, innovative deal strategies, and critical relationships that will power your business in 2026.

Start your year at the event that sets the tone for energy project finance. While there may be imitators, Projects & Money remains unmatched in delivering the insights and access needed to succeed in today’s expanded and evolving energy market.

Hear from top industry leaders

and market stakeholders

Gain highly-relevant,

exclusive insights and updates

Connect with key decision-makers

and get deals done

2026 FEATURED SPEAKERS

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

2026 SPEAKING ORGANIZATIONS

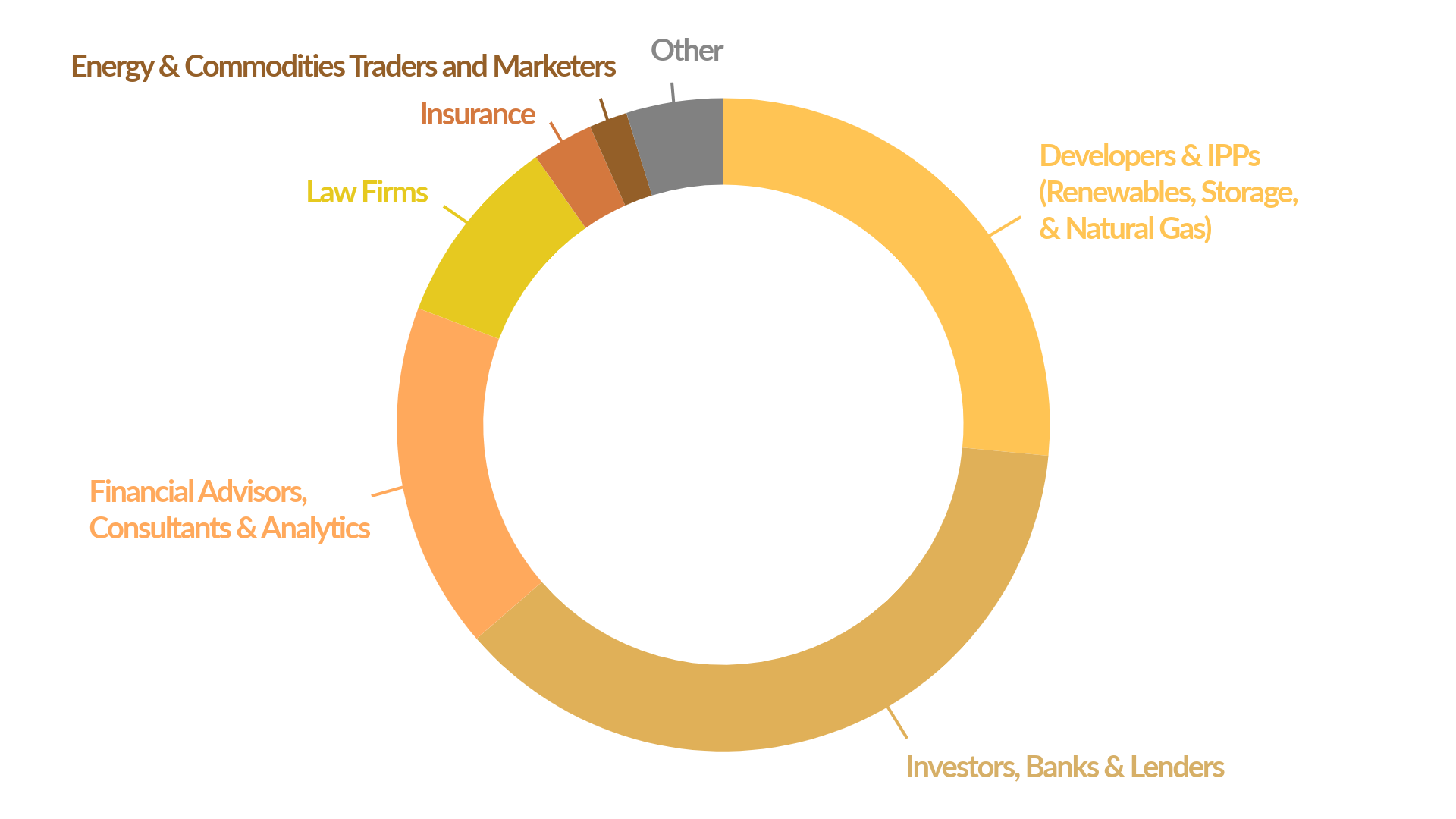

WHO SHOULD ATTEND?

Developers & IPPs of Power Generation Projects Across Gas, Thermal, Renewables & Other Emerging Clean Energy

Investment & Commercial Banks & Lenders

Energy & Commodities Traders & Marketers

Utilities

Financial Advisors, Analysts & Consultants

Tax Equity, Private Equity & Infrastructure Investors

Energy Offtakers & Buyers

Insurance Providers

Law Firms

EPCs & Equipment Suppliers

PAST PARTICIPATING ORGANIZATIONS

2025 RECAP

"One of the best conferences of the year. Beautiful venue, intimate setting, and very well organized!"

— Bill Miller, MITSUBISHI HITACHI POWER SYSTEMS

"A very valuable conference for the industry! A review of last year’s statistics and the forward look at the market sets the stage for potential transactions, capital supply, players, etc. A very well attended event!"

— Lori Kepner, COBANK

"If you can only make one conference a year,

this is the one!"

— Jeff Carusone, FIRST AMERICAN TITLE INSURANCE

"Great panels with relevant and timely issues. A must place to be for meeting top industry players."

— Daniel Hanson, TRI-STATE TAX & ACCOUNTING EA

"Terrific Conference. Speakers provide real-time information on the state of financial and investor markets. One of the best energy financing conferences you can attend."

— Merrill Kramer, PIERCE ATWOOD LLP

"The Projects & Money conference in New Orleans always delivers!

The panels are packed with content and move along at a great pace."

— Jean Bailie, NFRONT CONSULTING LLC

venue

Hyatt Regency New Orleans

601 Loyola Ave

New Orleans, LA 70113

Phone: (504) 561-1234

WARNING: Please do not book any guest rooms with third-party housing companies for this event. Infocast does not partner with outside housing companies, so we advise that you only book guest rooms directly through the venue using the details provided above.

Nearby Hotels

Copper Vine Inn

1001 Poydras St, New Orleans, LA 70112

504-788-2110

Click here

0.3 miles from Hyatt Regency New Orleans

Virgin Hotels New Orleans

550 Baronne St, New Orleans, LA 70113

504-603-8000

Click here

0.3 miles from Hyatt Regency New Orleans

Hyatt House New Orleans/Downtown

1250 Poydras St, New Orleans, LA 70113

504-648-3118

Click here

0.2 miles from Hyatt Regency New Orleans

sponsors

To receive more information about this event, please fill out the form below:

)