June 16 - 17, 2026 | Hyatt Regency La Jolla | San Diego, CA

June 16 - 17, 2026 | Hyatt Regency La Jolla | San Diego, CA

2025 was a banner year for storage additions on the US grid despite diametric forces: massive load growth, OB3 tax incentive runway preservation, FEOC and Material Assistance questions, power price hikes, lithium price falls, lower interest rates, and other new ITC compliance, and more. Even with logistical challenges, the value that storage brings to both project economics and grid stability is too compelling to put on hold, as developers and investors push projects forward to maximize potential revenue.

Storage must pivot to capture OB3’s tax incentives while they can. With massive growth projected long-term, the energy storage market faces potential near-term contraction due to FEOC related supply chain adjustments, despite rising manufacturing capacity and continued innovation. How can the market adjust to new requirements, maintain momentum, and seize the ITC opportunities for investment once storage and wind’s incentives sunset?

Storage has the potential to increase the profitability of all projects. While this represents enormous opportunities, how does the industry inform the legislature, the public, data centers, and other large load that energy storage is a necessary grid stabilizing, cost reducing tool that should be financed and deployed at scale? How does energy storage finance and development continue to adapt to the risks and seize the opportunities available in today’s markets?

New development will continue, but only those with the right insight and connections will tune out the noise and grasp the opportunities ahead.

Energy Storage Finance & Investment brings together the entire storage community, including the country’s leading developers, tax equity investors, capital and debt providers, tax advisors, market analysts, offtakers, and more to provide a deep dive into navigating the uncertainties and moving forward with cutting-edge approaches for finance and investment across the full range of markets and business strategies in this dynamic space.

If you want the best available information on contract negotiations, revenue streams, costs, tax equity and credit markets, FEOC and Material Assistance, augmentation, M&A, merchant transactions, procurement plans, supply chain risk, domestic equipment availability, the opportunities and pitfalls across the full range of ISO, RTO and bilateral markets, extracting value from projects and portfolios, and how the storage markets are adapting to changing political risk and new market signals — you need to attend this remarkable event.

Hear from top industry leaders

and market stakeholders

Gain highly-relevant,

exclusive insights and updates

Connect with key decision-makers

and get deals done

Get visibility for your brand

Lawrence Silverstein

Director of Sponsorship

lawrences@infocastevents.com

For registration questions

Group rates available,

for 3 or more attendees!

registration@infocastevents.com

Share your expertise

Victoria Hoefler

Conference Producer

victoriah@infocastevents.com

Save up to $700 with Early Bird Pricing!

Group rates available for 3 or more attendees!

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

HEAR FROM INDUSTRY LEADERS & EXPERTS

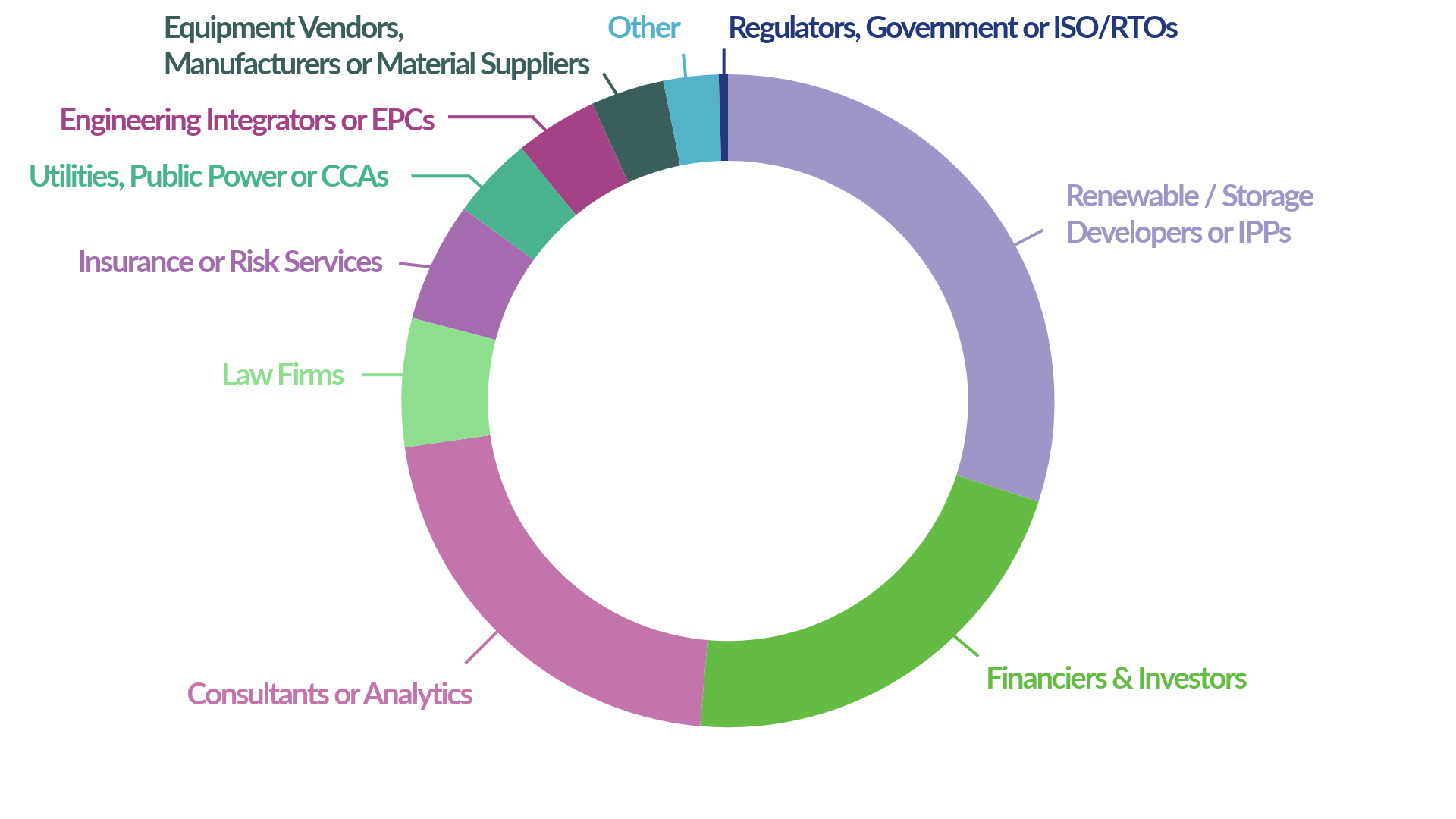

WHO SHOULD ATTEND?

Renewable/Storage Developers or IPPs

Utilities, Public Power or CCAs

Engineering, Integrators or EPCs

Equipment Vendors, Manufacturers or Material Suppliers

Insurance or Risk Services

Financiers or Investors

Law Firms

Consulting or Analytics

Regulators, Government or ISO/RTOs

Law Firms

PAST PARTICIPATING ORGANIZATIONS

Renewable & Storage Developers:

Financiers:

Financiers:

Law Firms, Consultants and Advisors:

2025 RECAP

venue

Hyatt Regency La Jolla

3777 La Jolla Village Drive

San Diego, California, 92122

Room Rate: $289

Reservation Call-In No: (858) 552-1234

Reservation Web Link: Click here

Cutoff Date: Wednesday, May 27, 2026

Group Name: Energy Storage Finance & Investment 2026

WARNING: Please do not book any guest rooms with third-party housing companies for this event. Infocast does not partner with outside housing companies, so we advise that you only book guest rooms directly through the venue using the details provided above.

Please be advised that Infocast Events and Clarion Events—and their official vendors—do not sell attendee lists. Any organization or individual claiming to offer access to our attendee data is not affiliated with Infocast Events in any capacity and does not have access to legitimate or accurate attendee information. We urge you to exercise caution and disregard these unauthorized solicitations.

registration

*Discounts cannot be retroactively applied to an existing registration

Need help with registration?

Contact us at: registration@infocastevents.com | (818) 888-4444

)