CCS / Decarbonization Project Development, Finance & Investment

July 23 - 25, 2024

Hilton Houston Post Oak by the Galleria

Houston, TX

The Deepest Dive into the Economic and Regulatory Factors Driving the Success of the CCS/CCUS Project Development Landscape

Spurred by billions in government funding and support from the IIJA, and billions more in tax credits from the IRA, the carbon capture, utilization, and storage (CCUS) industry saw an explosion of new projects in 2023 — and has even stronger prospects for the future.

However, getting all these projects to the point of ‘steel in the ground’ will mean finding a way past a series of obstacles that have also become more visible in the past year. Those obstacles include navigating the complicated and painfully prolonged permitting process, finding structures to optimally utilize state and federal credits (once those have been fully defined), and the aligning of project economics with existing market realities. Only the best informed will be positioned to effectively manage their project economics and regulatory requirements in order to bring lucrative and important decarbonization projects to commercialization.

Infocast’s CCS/Decarbonization Project Development, Finance & Investment Summit has been designed to bring together the industry’s leading project developers, emitters, providers of tax equity, development capital and cash equity for the best deep-dive into the business of carbon capture. It will cover today’s cutting- edge developments, critical market intelligence on guidance and regulations being implemented today and provide an “inside view” from the perspectives of all the players in these deals on how project economics can be optimized to successfully execute deals. Infocast’s meeting will once again gather the top players in the industry to provide the best available discussion of:

- How permitting issues impact project valuation and financing, and what strategies should be employed to move projects more easily along the pipeline

- Strategies to handle the complex and prolonged regulatory issues surrounding carbon capture

- Industry best practices in interpreting and applying the latest IRS guidance to successfully develop compliant projects

- Analyses of evolving deal structures and alternative revenue streams to maximize project economics and value

This is a unique opportunity to meet the people you’ll need to meet and learn the lessons you'll need in order to participate in scaling up CCUS and DAC project commercialization in the US market. Review our program outline and reserve your place today.

Plus! Don’t miss our deep dive Executive Briefing: Assessing and Managing CCS/CCUS Project Economics Across the Development Lifecycle, providing you with a unique opportunity to understand the fundamental drivers, risks, and commercial challenges of carbon capture projects to help your projects succeed in this exciting industry.

Get visibility for your brand

Lawrence SilversteinDirector of Sponsorship

[email protected]

For registration questions:

Group rates available,for 3 or more attendees!

[email protected]

Share your expertise

Victoria HoeflerConference Producer

[email protected]

70

Expert Speakers

Hear from top industry leaders

and market stakeholders

24

Content-Packed Sessions

Gain highly-relevant,

exclusive insights and updates

Premier Networking

Connect with key decision-makers

and get deals done

FEATURED SPEAKERS

William Aljoe

Technology Manager - Carbon Storage Infrastructure, National Energy Technology Laboratory

U.S. DEPARTMENT OF ENERGY

Noah Deich

Senior Advisor,

Office of Fossil Energy

and Carbon Management

U.S. DEPARTMENT OF ENERGY

Lily R. Barkau, P.G.

Groundwater Section Manager, Water Quality Division

WYOMING DEPARTMENT OF ENVIRONMENTAL QUALITY

Sriram Chandrasekaran

Director, Global Banking Americas, Low Carbon Transition Group

BNP PARIBAS

Richard A. Esposito, Ph.D.

Program Manager, Geosciences and Carbon Management

NET ZERO TECHNOLOGIES SOUTHERN COMPANY

Bret Estep

Vice President - Development

TENASKA

Matt Fry

Senior Policy Manager - Carbon Management

GREAT PLAINS INSTITUTE

David Heikkinen

Chief Development Officer

WHITE HAWK ENERGY

Eric Heintz

Managing Director of Renewable Energy Finance

M&T BANK

Alexia Kelly

Managing Director, Carbon Policy & Markets Initiative

HIGH TIDE FOUNDATION

Nick Knapp

Partner & Senior Managing Director

CRC-IB

Dawn Lima

Vice President, Renewable Energy & Sustainable Technologies

FOSS & COMPANY

Bret J. Logue

Chief Executive Officer

ELYSIAN CARBON MANAGEMENT

Charles McConnell

Executive Director, Carbon Management and Energy Sustainability, Chancellor/President’s Division

UNIVERSITY OF HOUSTON

Scott McDonald

Director of Biofuels Development

ARCHER DANIELS MIDLAND

John McDougal

Vice President of Environmental Products

ANEW CLIMATE

Bryce McKee

Carbon Sequestration Group, Oil and Gas Division

RAILROAD COMMISSION OF TEXAS

Justin Merkowitz

Managing Director, Head of Project Finance

COBANK ACB

Matt Miller

Managing Director

GREY ROCK INVESTMENT

Chris Otte

Managing Director

CIBC

Justin Peltier

Vice President, Energy Transition Ventures

KINDER MORGAN

Max Scholten

Head of Commercialization

HEIRLOOM

Matt Shanahan

Managing Director

MARATHON CAPITAL

Alexander Shelby

Director

BARCLAYS

Jerry Smith

Managing Director, Head of Tax Insurance

ATLANTIC GLOBAL RISK

Christina Staib

Global Finance Impact Lead

GLOBAL CCS INSTITUTE

Jordan Tamchin

Executive Vice President, Tax Insurance Practice Leader

CAC SPECIALTY

Alex Tiller

CEO

CARBONVERT INC.

Beth (Hardy) Valiaho

VP - Policy, Regulatory & Stakeholder Relations

INTERNATIONAL CCS KNOWLEDGE CENTRE

James J. Wolff

Chief Executive Officer

ENCHANT ENERGY

Olivia Woodruff

Director, Decarbonization

KIMMERIDGE

Noah Zerance, CFA

Global Sustainable Finance Group - Asset Finance

BANK OF AMERICA

HEAR FROM INDUSTRY LEADERS & EXPERTS

- ACR at Winrock International

- Anew Climate

- Archer Daniels Midland

- Atlantic Global Risk

- Bank of America

- Barclays

- Battelle

- Black & Veatch

- BNP Paribas

- CAC Specialty

- California Resources Corporation

- Capturiant

- Carbon Limit

- Carbonvert Inc.

- CIBC

- Clean Air Task Force

- Climate Bonds Initiative

- CoBank ACB

- CRC-IB

- Elysian

- Empact Technologies

- Enchant Energy

- Foss & Company

- Frontier Carbon Solutions

- Global CCS Institute

- Great Plains Institute

- Grey Rock Investment Partners

- Heirloom

- High Tide Foundation

- International CCS Knowledge Centre

- Kimmeridge

- Kinder Morgan

- Linklaters

- M&T Bank

- Marathon Capital

- Norton Rose Fulbright US LLP

- Railroad Commission of Texas

- SABIC

- Southern Company

- Tenaska

- U.S. Department of Energy

- University of Houston

- White Hawk Energy

- Wilson Sonsini

- Wyoming Department of Environmental Quality

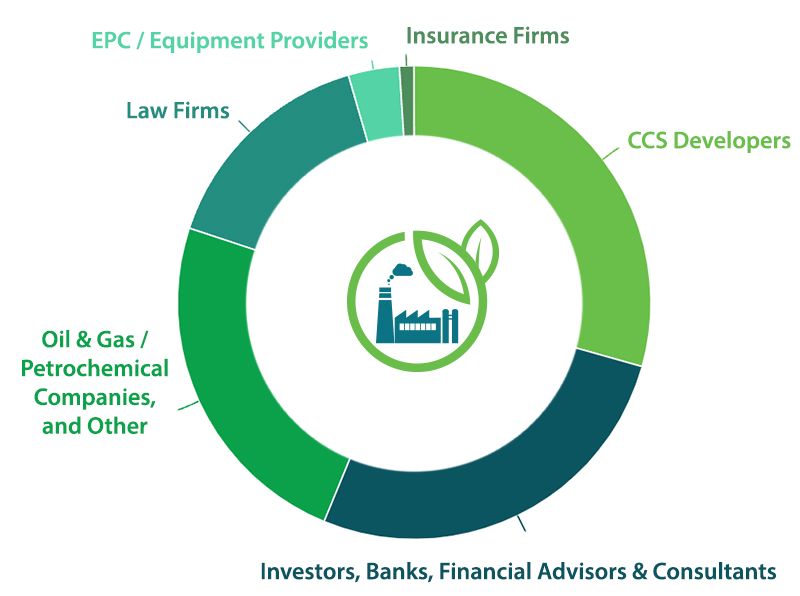

WHO SHOULD ATTEND?

- CCS & CCUS Project Developers

- Tax Equity, Venture/Development Capital, and Debt Equity Providers

- Clean Energy Project Developers

- IPPs, Refineries, and Industrial Facilities

- Carbon Capture Equipment Manufacturers,

Engineering Firms, & EPC’s - Law Firms

- Owner/Operators and Managers of Oil & Gas Fields, Gas Storage Facilities and Pipelines

- CO2 and Carbon Transportation Technology Developers

- Energy Majors

- Hydrogen Producers

- Local, State and Federal Regulators and Agencies

- Consultants & Analysts

PAST PARTICIPATING ORGANIZATIONS

- 174 Power Global

- 8 Rivers Capital

- ABB Inc.

- Accenture

- Ag-Grid Energy LLC

- Air Liquide

- Akin

- Alcove

- Allen & Overy LLP

- AlphaStruxure

- American Air Liquide Holdings, Inc.

- American Hydrogen, LLC

- Amp Americas

- APA Group

- Arch Insurance Group

- Archaea Energy

- Ares Management

- Ark-La-Tex Financial Consultants

- Avalon International

- Baker Botts LLP

- Bakken Energy

- Bank of America

- BASF

- Battelle

- Bechtel Enterprises

- BerQ RNG

- Black & Veatch

- Blue Ridge Bank, NA

- BNP Paribas

- BP

- Bracewell LLP

- Bridge Energy

- Buckeye Partners, L.P.

- CAC Specialty

- Cantor Fitzgerald

- Capital Power

- Capstone LLC

- Carbon Advocacy Project

- Carbon America

- Carbon Infrastructure Partners

- Carbon Utilization Research Council (CURC)

- Carbon Vault Holdings LLC

- Carbonvert

- Carbonvert Inc.

- CEMEX USA

- Certarus

- Chabina Energy Partners, LLC

- Chevron

- CIBC

- CIM Group

- Clean Air Task Force

- Clean Development International

- Clean Energy Systems

- Cleco

- Climate Adaptive Infrastructure

- Climate Investment

- Climeworks

- CMS Enterprises

- CO2SeQure

- Cogentrix Energy Power Management, LLC

- CohnReznick

- Competitive Power Ventures

- Constellation

- CPPIB America, Inc.

- CPV

- Credit Agricole

- Dastur Energy Inc.

- Deloitte

- Dezato Gas Inc

- DNB Bank

- DNV

- Dow

- Drax

- EDL - Energy Developments Limited

- Elysian Carbon

- Enbridge, Inc.

- Enchant Energy

- Enerflex

- EnLink Midstream

- ESGWAY Corporation

- Euclid Transactional, LLC

- Evergrow

- ExxonMobil

- Fagen, Inc.

- First American Title Insurance

- Foley & Lardner LLP

- Foss & Company

- Fredrikson & Byron PA

- Freepoint Commodities

- Gaffney, Cline & Associates

- GE

- Gemma Power Systems

- Generate Capital

- Geoex MCG LLC

- Global Carbon Capture and Storage Institute

- Global Infrastructure Partners

- Global Thermostat

- Goldman Sachs

- Great Plains Institute

- Grey Rock Investment Partners

- GSF Advisors

- Guidehouse

- Harrison Street

- HIF Global

- Honeywell UOP

- Houlihan Lokey

- Husch Blackwell LLP

- Hydrozonix

- IFM Investors

- Illinois Clean Fuels

- Infinite Cooling Inc.

- ING Capital LLC

- Innosepra CO2 Capture

- Iogen Corporation

- J.P. Morgan

- Jefferies LLC

- Jupiter Oxygen Corp

- Kiewit Corporation

- Kirkland & Ellis LLP

- Lapis Energy

- Latham & Watkins LLP

- Lhoist

- Linde, PLC

- Linklaters LLP

- LNG Americas

- Lockton Companies

- Louisiana Economic Development

- LS Power

- Macquarie Capital (USA) Inc.

- Marathon Capital

- Marsh USA Inc.

- MasTec

- McDermott, Will & Emery

- Mercuria Energy America LLC

- Milestone Carbon

- Mintz

- Molpus Woodlands Group

- Munich Re

- Navigator CO2

- NET Power

- NextDecade

- Nixon Peabody LLP

- Northern Biogas

- Norton Rose Fulbright US LLP

- NOVUS Wood Group, L.P.

- OGCI Climate Investments LLP

- Orennia

- Oxy Low Carbon Ventures

- PA Consulting Group, Inc.

- Partners Group

- Pathway Energy

- PCL Construction

- Pelican Energy Consultants

- Permian Oilfield Partners

- Phillips 66

- Pickering Energy Partners

- Piper Sandler

- Polsinelli, P.C.

- Project Canary

- Purple Land Management

- PurposeEnergy LLC

- Quantum Capital Group

- Rabobank

- Renewa

- Repsol

- Rystad Energy

- Schlumberger

- Sempra Infrastructure

- Shell

- Sidley Austin LLP

- Solaris Global LLC

- Southern Company

- Stakeholder Midstream

- Standard Charter Bank

- Stanford University

- Stark Tech

- Sumitomo Corporation of Americas

- Sumitomo Mitsui Banking Corporation

- Summit Carbon Solutions

- Sustainable Foundation

- Svante, Inc.

- Synthica Energy

- Tallgrass

- Talos Energy

- TC Energy

- Tellurian Inc.

- Tenaska, Inc.

- Tokyo Gas America

- Trace Carbon Solutions

- Tyr Energy

- U.S. Department of Energy (DOE)

- Ulteig

- United Energy Trading

- University of Kentucky College of Engineering

- University of Wyoming

- Vault 44.01

- Verbio North America

- Verde Climate Solutions

- Viking Carbon

- Vine Investment Partners, LLC

- Vinson & Elkins

- Warwick Carbon Solutions

- Wells Fargo

- Western Midstream Partners, LP

- Westmoreland

- Weyerhaeuser Company

- White & Case LLP

- Williams

- Wilson Sonsini Goodrich & Rosati

- Winston & Strawn LLP

- Wolf Carbon Solutions US

- Woodside Energy

- World Resources Institute (WRI)

- WSGR

- WSP USA

- ...and more!

2023 RECAP

65

Expert Speakers

17

Sessions

Premier Networking

VENUE

Hilton Houston Post Oak by the Galleria

2001 Post Oak Boulevard

Houston, Texas 77056

Phone: (713) 961-9300

Room Rate: $169

Reservation Call-In No: (800) 245-7299

Reservation Web Link:

Click here

Cutoff Date: July 5, 2024

Group Name: CCS Decarbonization Project Development F&I

**WARNING: Please do not book any guest rooms with 3rd Party Housing Companies for this event. Infocast does not partner with outside housing companies, so we advise that you only book guest rooms at the hotel using the details provided above.**

Sponsors

Platinum Sponsor

Platinum Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Gold Sponsor

Supporting Organization

Registration

For Utilities, Government, and Non-Profit pricing, click here.

*Discounts cannot be retroactively applied to an existing registration.

Need help with registration?

Contact us at: [email protected] | (818) 888-4444